Joint Tenants or Tenants in Common | What if the Deed Doesn't Specify?

A common question we receive in our office is what is the difference between joint tenants and tenants in common? While both are ways to hold property among two or more people – concurrent ownership – they each carry big differences when it comes to what happens to the holder’s interest in the property when they pass away. Particularly, one may lock the holder’s family into a probate while the other only requires the filing of one deed with the county recorder.

Firstly, you will often see the phrase concurrent ownership. Concurrent ownership simply refers to a given piece of property being owned by two or more persons at the same time, simultaneously. Concurrent may also be commonly swapped out with joint, common, community or co-ownership. Think of these as umbrella terms under which there are various types of concurrent ownership such as joint tenants, tenants in common or tenant in the entirety. However, joint tenants and tenants in common are overwhelmingly more common and thus the types we’ll be focusing on below.

Joint Tenants

Joint tenancy is co-ownership (i) with a right of survivorship of an interest in real property between two or more persons, (ii) created by the act of the parties and (iii) requiring a unity of possession, interest, title and time.

(i)

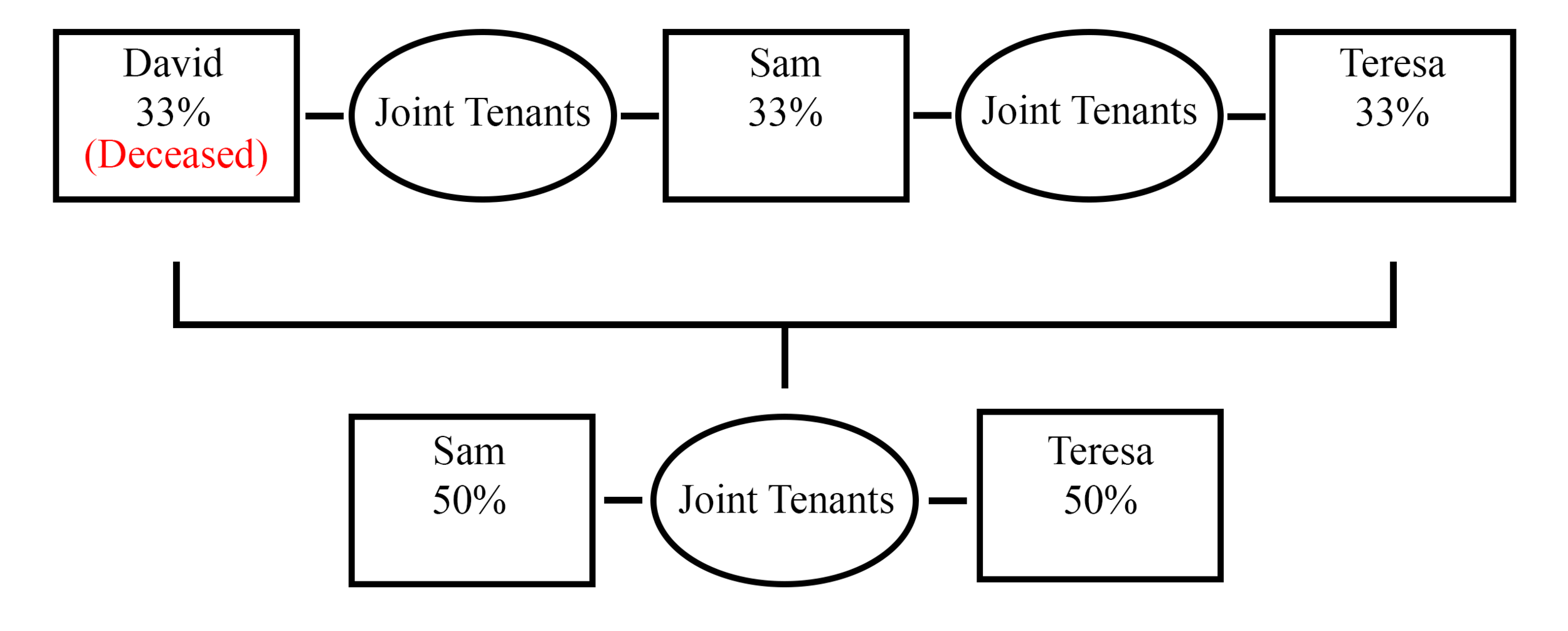

The most important feature of joint tenancy is the automatic right of survivorship that comes with holding property as joint tenants. What a right of survivorship means is on the death of one co-owner, their interest terminates automatically, and the property is then held outright by the surviving co-owner. I.e., the deceased owner’s interest goes to the surviving owner. Below are some simple examples of how this plays out:

Here, David and Sam held property as joint tenants 50% each. When David passed away, his interest automatically passed to Sam. The result, Sam now owns the property 100%.

Here, David, Sam and Teresa held property all as joint tenants, 33% each. When David passed away, his interest automatically passed to Sam and Teresa equally. The result, Sam and Teresa now own the property, still as joint tenants, 50% each.

(ii)

An act of the parties simply refers to the fact that joint tenancy cannot be created by operation of law. Operation of law simply means something occurring automatically as specified in law. The parties must receive the property by an instrument specifying joint tenancy such as purchasing the property or receiving such as a gift. This is contrasted with receiving the property as an inheritance.

(iii)

Possession, interest, title, and time of receipt must all be the same. Possession refers to the co-owners having an equal right to possess the whole of the property. Interest means all co-owners must have an equal interest in the land (E.g., 50/50). Title means all co-owners must have received title from the same source. Finally, time refers to all co-owners needing to receive their interests at the same time.

Tenants in Common

Tenants in common is co-ownership wherein each owner has an (i) undivided interest in the property (ii) with no right of survivorship and (iii) only requiring a unity of possession.

(i)

Here, an undivided interest means that all co-owners have the same current interest in the property, as opposed to a future interest. This simply means they must own the property now, not expect to receive the property down the line.

(ii)

The biggest difference between joint tenancy and tenants in common is the fact that tenants in common do not have a right of survivorship in the property. This is where probate concerns arise – where a co-owner of a property as tenant in common passes away. Below are some examples of common scenarios:

Here, David and Sam held property as joint tenants 50% each. When David passed away, his interest does not pass to Sam, but rather to David’s heirs of his estate. The result, Sam retains a 50% interest in the property, but the remaining 50% is held equally among David’s heirs.

Here, David, Sam and Teresa held property all as joint tenants, 33% each. When David passed away, his interest does not pass to Sam and Teresa, but to his David’s heirs of his estate. The result, Sam and Teresa retain their 33% interests each, but the remaining 33% is held equally among David’s heirs.

(iii)

Tenants in common only requires each co-owner have an equal right to possess the whole of the property. There does not need to be equal interests held by each co-owner. For example, David could hold 60%, while Sam holds the remaining 40%, and the property may still be held as tenants in common. Finally, co-owners need not have received their interests at the same time or from the same source. For example, Dave could have received his interest as an inheritance while Sam received their interest as a gift a year prior.

Synthesis

As you can see, a potential probate is always a looming issue. David’s share in the tenants in common examples was held by himself as an individual rather than in a trust that could avoid probate. Additionally, should Sam never transfer their interest in the property they receive from David under the joint tenancy examples, Sam’s heirs would need to go to probate court upon Sam’s death should they never transfer their interest to a trust.

However, an uncommon but extremely costly problem arises where the deed granting the property to David and Sam, for example, does not specify whether the property is to be held as joint tenants or tenants in common. According to the California Civil Code Section 686, unless otherwise specified on a deed, granting a property to two or more parties is presumed to be as tenants in common. Additionally, if the deed is also silent as to each co-owner’s ownership share, equal shares among all will also be presumed.

Keep in mind, while this is a presumption, rebutting such would be very difficult as you would need to show some convincing evidence the parties intended to hold the property in some different fashion. Thus, absent something very explicitly countering the presumption, parties will be “locked in” to doing a probate to pass title on to one’s heirs, including all the delays, additional thousands of dollars in fees/costs and headache that entails.

Contrast this with simply having a law firm prepare a new deed and recording such with the county recorder for a nominal charge and recording fee as can be done with joint tenancy, or simply spending a little more and having an attorney draw up an estate plan to avoid probate and direct the distribution of one’s estate according to their wishes.

There are, of course, many other topics and issues that can arise in such situations such as breaking joint tenancy; rights and duties of co-owners; and avoiding probate by establishing a living trust, but those are topics for another post.

If you have a question regarding property you own with another, then please call our office at (909) 307-6282 for a complementary consultation and complementary real property analysis.